Since january 2006 medicare beneficiaries have the option to purchase prescription drug benefits from medicare under the part d program. Since january 2006 medicare beneficiaries have the option to purchase prescription drug benefits from medicare under the part d program.

Medicare part d, offered separately through medicare, encompasses prescription drug plans.

Medicare part d copayments. Part d plans group different drugs into cost levels known as tiers, and each of these requires a separate amount that you pay as your share. Part d is an optional medicare benefit that helps pay for your prescription drug expenses. Medicare part d is required to offer coverage for at least two prescription medications in the six medication categories:

Part d prescription drug coverage helps millions of original medicare beneficiaries pay for their medication costs. The annual deductible, initial coverage, the coverage gap, and catastrophic coverage. $45 for tier 2 drugs;

Cosponsor the home & community services copayment equity act (h.r. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer part d programs through the medicare system.

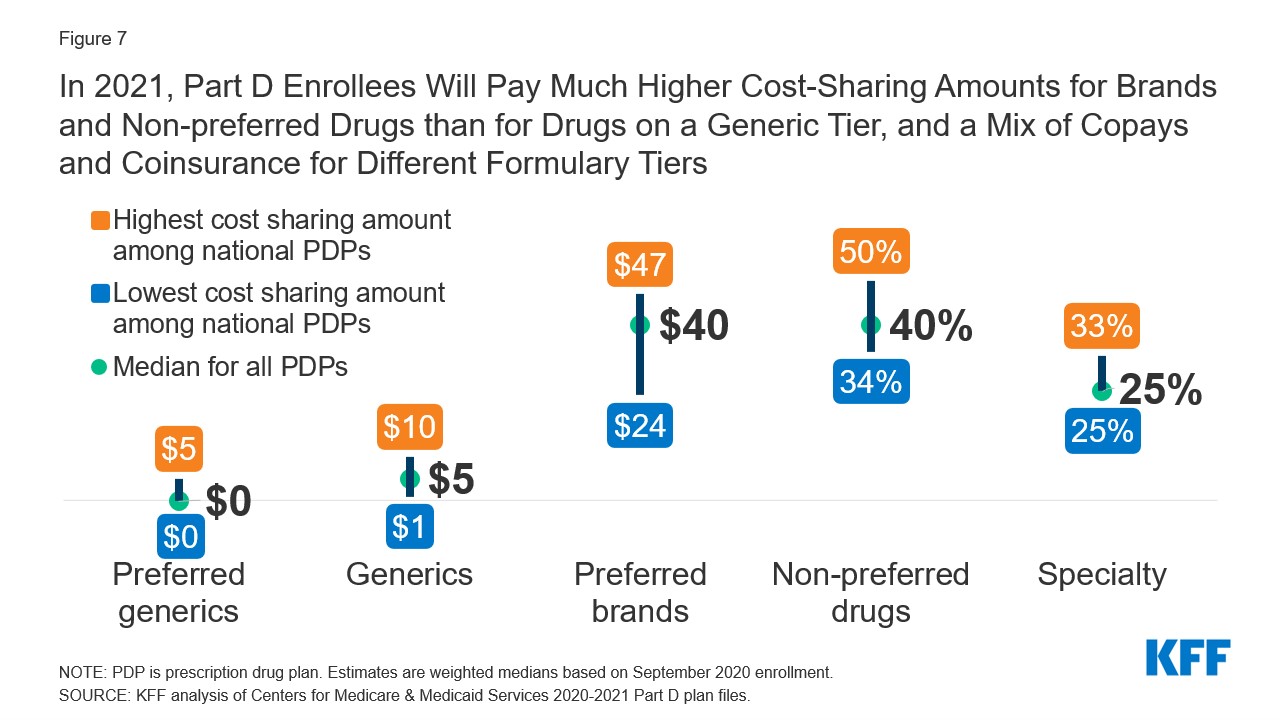

Copayments vary depending upon the prescriptions’ tiers. Medicare part b does not usually have a copayment. Each plan uses a different formulary — or list of drugs it covers.

Copayments are then required, with generic medications. Medicare part d deductibles, copayments, and coinsurance. It is a private supplemental insurance plan.

The addition of outpatient drugs to the medicare programs reflects congress� recognition of the fundamental change in recent years in how medical care is delivered in the u.s. Those benefits, however, come at a price. Medicare part d copayments and coinsurance in part d plans may be determined by the carrier.

The amount you pay relates to the tier your. Since january 2006 medicare beneficiaries have the option to purchase prescription drug benefits from medicare under the part d program. And 33 percent of the cost for tier 4 drugs.

Nonetheless, medicare part d will cover the majority of these costs. Medicare part d prescription drug plans often require payment of a plan premium, and some plans require an annual deductible to be met before the plan begins to pay for drugs. In short, once you pay the plan deductible, you will be responsible for copayments or coinsurance for each prescription instead of the full cost.

Part a hospice care copayment and part b copayment: The amount you must pay for health care or prescriptions before original medicare, your medicare advantage plan, your medicare drug plan, or your other insurance begins to pay. Hospital stays always generate the highest copay somewhere between $275 and.

$80 for tier 3 drugs; The addition of outpatient drugs to the medicare programs reflects congress’ recognition of the fundamental change in recent. In 2019, the part d coverage deductible is $415.

It requires a monthly premium as well as potential copayments for ordered prescriptions. If you take three prescription medications for example, you could pay a $10 copayment for tier one medications, a $20 copayment for tier two medications and a $30 copayment for tier three medications. Most medical services incur a copayment.

If you are enrolled in medicare part d for prescription drug coverage, your plan can charge a copay for prescription drugs — this amount. Beginning in 2006, insurance coverage for prescription medications was made available for people with medicare. Medicare part d offers coverage for prescription drugs, which each plan has the liberty to cover as it chooses.

Copayments at the pharmacy are determined based on your level of monthly premiums and which tier the drug falls into. Nationwide, the average monthly part d premium in 2020 is $30. You pay your share and your plan pays its share for covered drugs.

These costs are included in the following medigap plans: These plans work by creating a list of covered prescription drugs. There are four phases of medicare part d coverage:

A typical copayment for a pcp would be $25 and a specialist somewhere between $35 to $50. Medicare part d, tiered copayments, elasticity, risk score, formulary. Medicare part d copayments unfair for dual eligible assisted living residents action for congress:

Medicare part d is responsible only for prescription medications. In 2020, the maximum part d deductible is $435, but depending on where you live, you may find a plan with a lower deductible or even no deductible at all. And the drugs are arranged in tiers with different copayment or coinsurance amounts.

The annual deductible is adjusted each year by medicare. Since january 2006 medicare beneficiaries have the option to purchase prescription drug benefits from medicare under the part d program. The centers for medicare and medicaid services (cms) sets the maximum medicare part d deductible each year.

My heritage health plan has covered (if the plan has one). For example, for each prescription a plan may charge $5 for tier 1 drugs;

Antidepressants anticancer immunosuppressants hiv/aids medications antipsychotics anticonvulsants. 1 if you find a plan that’s cheaper, it might be tempting to snag it and call it a day. Some medicare part d plans have “tiers” of copayments and coinsurance with different medications on different tiers.

Here is an example of a medicare part d drug plan tier according to medicare.gov: Definition of medicare part d. Medicare parts a, c, and d have copayments and may also have deductibles and coinsurance.

Copayments, coinsurance, and deductibles may apply for. Medicare part d, offered separately through medicare, encompasses prescription drug plans. What does medicare part d cover?

Anticancer, anticonvulsants, antidepressants, antipsychotics, antiretrovirals, and immunosuppressants. Change medicare part d plans outside enrollment windows. 52 rows medicare part d provides coverage for prescription medications.

All plans cover nearly all drugs in six categories: Medicare part d your copayment will vary depending on your plan and the medications you are prescribed. The list of all of the medications covered constitutes the formulary.

If you find yourself outside the iep and aep, you may fall under the “special circumstances” category.contact a medicare agent who can quickly and easily tell you if your specific situation fits under one of the qualifiers for sep.