That’s possible, but not certain. A 14.5 percent jump in the medicare part b premiums for 2022 spells trouble ahead for beneficiaries wondering where the money will come from to pay all the bills, warns the senior citizens league (tscl).

Medicare part b premiums will rise 52% in 2016 from $104.90 to $159.30.

Medicare part a premiums 2016. Although medicare part b premiums have remained stable for several years, nearly a third of the roughly 50 million elderly americans who depend on medicare for their physician care and other health services could see their premiums jump by 52 percent or more next year. The medicare part b premium in 2016 is technically $121.80 for people whose yearly income is $85,000 or below. Those filing joint tax returns with annual.

“the part b increase from $148.50 to $170.10 per month is the highest since 2016 and will consume the entire annual cost of. That’s possible, but not certain. On november 10, 2015, the centers for medicare & medicaid services (cms) announced the 2016 medicare part b monthly premium and annual deductible amounts of $121.80 and $166, respectively.

Beneficiaries not subject to the hold harmless provision will pay $121.80. What�s in store for medicare�s part b premiums and deductible in 2016, and why? Part a costs (inpatient hospital):

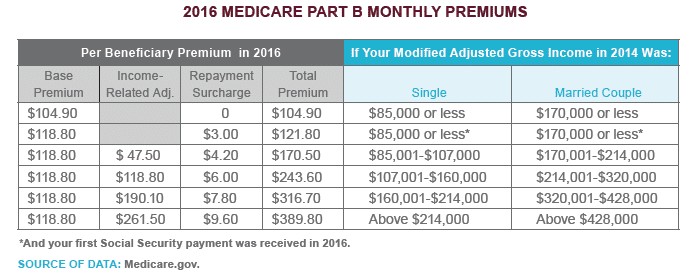

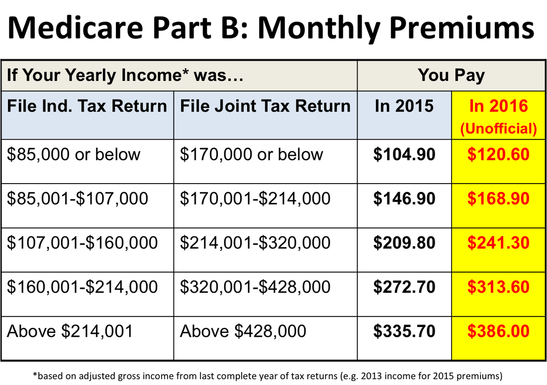

The new 2016 part a inpatient hospital deductible will be an increase of $28.00 to $1,288.00. Greater than $85,000 and less than or equal to $107,000 will pay $170.50; (the premiums for 2016 are based on the agi reported on 2014 tax returns.) an individual earning more than $85,000, but less than or equal to $107,000, will pay $170.50 a month in 2016, up from.

But about 30 percent of people covered by medicare will see a minimum part b premium of $134.00, a 10 percent increase from the minimum 2016 premium of $121.80. As an example, each member of a married couple with household income ranging from $170,000 to $214,000 a year would pay a part b premium in 2016 of $223.00. However, most medicare beneficiaries will not see an increase in their monthly part b premiums because of a.

How much you�ll pay for medicare part b in 2016. If you are receiving social security your check will be lower. As an example, each member of a married couple with household income ranging from $170,000 to $214,000 a year would pay a part b premium in 2016 of $223.00.

The new 2016 medicare parts a and b costs are below: The centers for medicare & medicaid services has announced that the standard monthly part b premium will be $121.80 in 2016. Remember the part a deductible starts over every 60 days.

Will your part b premiums go up in 2016?. So, what’s the medicare premium in 2016? Medicare part a also covers qualifying stays in a skilled nursing facility.

Starting january 1, most people with medicare will see a small increase in their part b premium, from $104.90 to an average of $109.00 per month. The medicare part b premium will increase from $104.90 to $121.80 in 2016, but the hold harmless provision in the social security act exempts most people from the increase because there will be no cost of living adjustment in social security next year. Less than or equal to $85,000 will pay $121.80 in 2016;

“the part b increase from $148.50 to $170.10 per month is the highest since 2016 and will consume the entire annual cost of living. You will pay all costs for days beyond lifetime reserve days. Hold on to your wallet.

Many will see higher premiums and $0 for the first 20 days of each benefit period. A 14.5 percent jump in the medicare part b premiums for 2022 spells trouble ahead for beneficiaries wondering where the money will come from to pay all the bills, warns the senior citizens league (tscl).

Medicare part b premiums will rise 52% in 2016 from $104.90 to $159.30. Medicare beneficiaries in these groups would see bills jump to $159.30 a month unless the obama administration took steps to lessen the pain. People who have to pay a higher premium because of their income and people.

Next year is going to be costly for many georgia retirees on medicare. “premiums would top out at $509.80. Those with retirement incomes between $85,000 and $107,000 ($170,000 to $214,000 for couples) will pay $170.50 in medicare part b premiums in 2016.

Medicare part b changes in 2016. On november 10, 2015, the centers for medicare & medicaid services (cms) announced the 2016 medicare part b monthly premium and annual deductible amounts of $121.80 and. But a bipartisan deal on the federal budget, signed by president obama on nov.

Greater than $214,000 will pay $389.80; The medicare part a annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. Greater than $107,000 and less than or equal to $160,000 will pay $243.60;

But, social security benefits did not go up this year. As a result, by law, most people with medicare part b will be held harmless from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. “premiums would top out at $509.80.

Because of projected part b spending increases and the need to build up an adequate level of contingency reserves, the medicare trustees estimate that monthly beneficiary premiums, under normal circumstances, would need to increase from $104.90 in 2015 to about $120.70 in 2016, an increase of $15.80 per month. All costs for each day after day 100 of the benefit period. Those with retirement incomes between $85,000 and $107,000 ($170,000 to $214,000 for couples) will pay $170.50 in medicare part b premiums in 2016.

2, has resulted in the premiums for those people being set at. Greater than $160,000 and less than or equal to $214,000 will pay $316.70; Premiums for enhanced pdps grew more rapidly than premiums for basic plans from 2015 to 2016 (11 percent.

The medicare part a annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. Retirees with high incomes have been paying bigger medicare part b premiums since 2007. The premium jumps to $243.60 for retirees earning from $107,000 to $160,000 ($214,000 to $320,000 for.

This issue brief provides an overview of the 2016 pdp marketplace, focusing on key changes from 2015, based on our analysis of data from the centers for medicare & medicaid services (cms)., in 2016, the typical medicare beneficiary will have a choice of more than two dozen pdps. One in 7 beneficiaries were facing a 52 percent increase in premiums, to $159.30 in 2016 — by far the largest jump in medicare�s history.