The beneficiary has a temporary limit on their part d coverage. Study patients were medicare advantage part d beneficiaries with diabetes from 2 large california health plans who were continuously enrolled in 2006 and had a drug coverage gap starting at $2250.

Not everyone will enter the coverage gap.

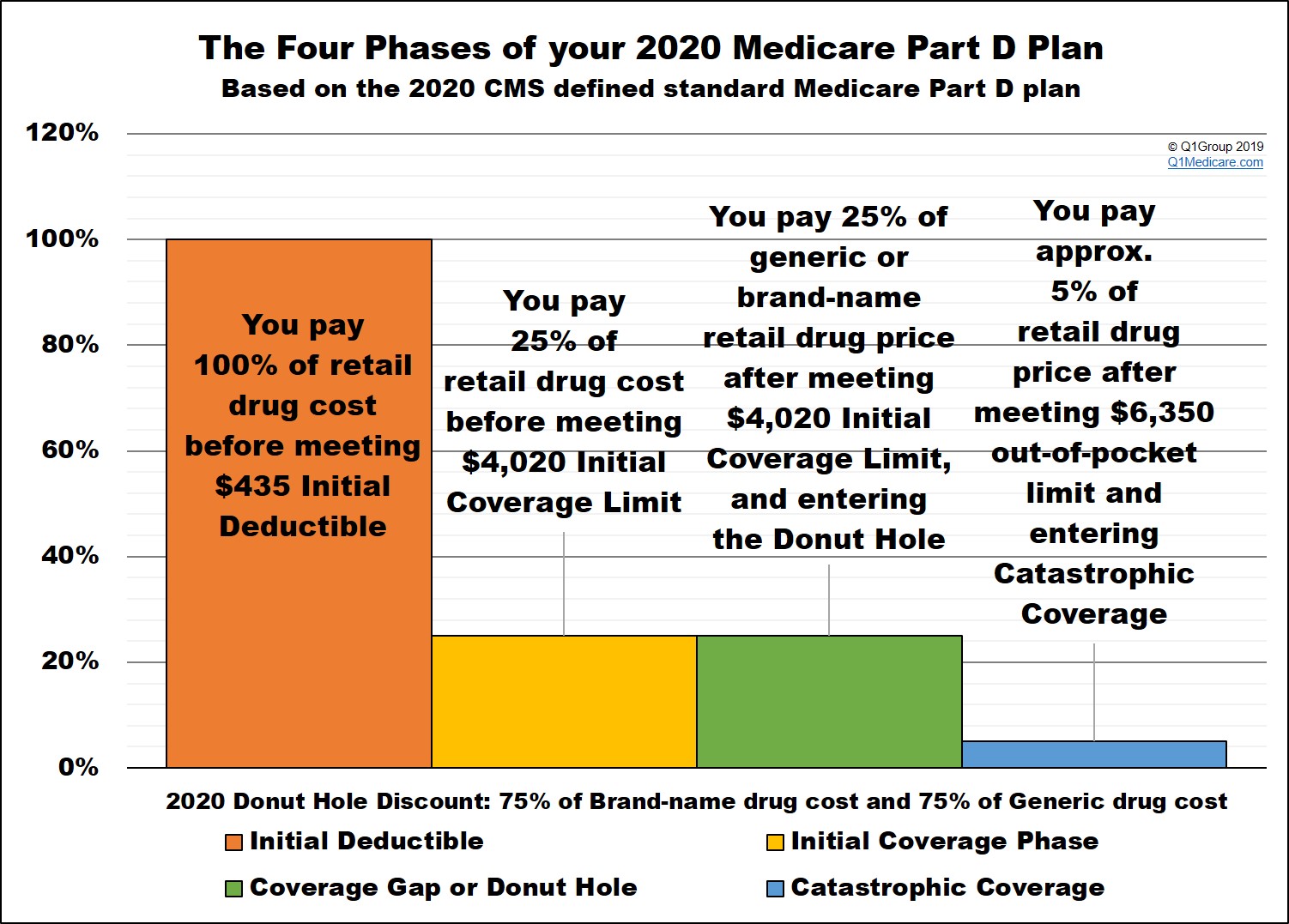

Medicare d coverage gap. In this video we are going to talk about the four stages of the medicare part d prescription drug coverage. The coverage gap begins after you and your drug plan have spent a. About the medicare part d prescription drug coverage gap (“donut hole”) last updated :

The coverage gap is the third stage in medicare’s four stage yearly progression of drug costs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap. Once you and your plan spend $4,430 on covered medications, you move into the coverage gap stage of medicare part d.

The medicare donut hole (coverage gap) the donut hole is more formally known as the medicare part d coverage gap. Medicare is clear that you may have a coverage gap in part d of your plan. Is the third payment stage of part d.

While in the coverage gap, you may temporarily pay more for your medications until you reach the next stage of coverage (catastrophic coverage). Background the standard medicare part d benefit is divided into four phases of coverage: The good news is that the affordable care act has closed the donut hole as of 2020, after several years of slowly shrinking it.

This includes the deductible, your initial coverage, the coverage gap (formerly referred to as the donut hole) and catastrophic coverage. While in this gap, plan members had to pay the full cost of their covered drugs until their total costs qualified them for catastrophic coverage. You’ll pay the remaining 25% of the price.

The beneficiary has a temporary limit on their part d coverage. The donut hole amount for 2022 is $4,430. Once you and your prescription drug plan have spent this amount on covered drugs,.

Coverage gap discount program payment validation for part c and d programs since the coverage gap discount program began on january 1, 2011, cms has been analyzing prescription drug event (pde) data to understand how many discounts have been provided in the coverage gap and for which classes of prescription drugs. What is the donut hole amount for 2022? Not everyone will enter the coverage gap.

This cost will continue until you reach the fourth stage, which is catastrophic. 11/06/2019 4 min read summary: In 2021, medicare will pay 75% of the price for generic drugs during the coverage gap.

The gap in coverage is intended to encourage beneficiaries to use generic drug alternatives that are less. Not everyone will enter the “donut hole,” and people with medicare who also have extra help will never enter it. The donut hole, or coverage gap, has long been one of the most controversial parts of the medicare part d prescription drug benefit and of concern to many people who have joined a part d drug plan.

You enter the coverage gap once you and your medicare part d plan have paid a certain amount toward your prescription drugs in one plan year. Deductible, initial coverage, coverage gap and catastrophic coverage. The medicare coverage gap is the phase of your medicare part d benefit after you and your plan spend a certain amount within a year.the gap officially closes in 2020, but you could still spend more than the initial coverage limit and then.

After you hit your initial coverage limit, you pay up. The portion you pay for prescriptions is usually higher in this phase until you enter the catastrophic level. During this stage, you pay a maximum of 25% of your plans cost for brand name.

Gross drug costs are what you pay, plus what your plan paid on your behalf. The donut hole (or coverage gap) is a term used to describe the third phase of your medicare part d prescription drug coverage. Study patients were medicare advantage part d beneficiaries with diabetes from 2 large california health plans who were continuously enrolled in 2006 and had a drug coverage gap starting at $2250.

The coverage gap is a temporary limit on what most medicare part d prescription drug plans or medicare advantage prescription drug plans pay for prescription drug costs. This coverage gap opened after initial plan coverage limits had been reached and before catastrophic coverage kicked in. Once you and your medicare part d plan have spent a certain amount on covered prescription drugs during a calendar year ($4,430 in 2022), you reach the coverage gap and are considered in the “donut hole.”.

This means there�s a temporary limit on what the drug plan will cover for drugs. The term “donut hole” is a metaphoric reference to the coverage gap. The medicare part d coverage gap (also known as the donut hole) is a coverage gap in your part d prescription drug coverage during which you may pay more for your prescription medications.

Most medicare drug plans have a coverage gap (also called the donut hole). The medicare part d coverage gap, also known as the donut hole, is the payment stage between the initial coverage limit and catastrophic coverage. Prior to 2011, enrollees were.

Once your gross drug costs reach $4,330 in 2022, you will enter the coverage gap (a.k.a. If you reach the donut hole portion of your drug coverage, you receive a 75% discount on all formulary drugs. The medicare part d “donut hole” is a temporary coverage gap in how much a medicare prescription drug plan will pay for your prescription drug costs.

What is the medicare part d donut hole? At this point, you enter what is known as catastrophic coverage, where you only pay a small copayment or coinsurance for medications. We know the coverage gap may be confusing or frustrating for you.

Most people recognize this after entering the third stage of their medicare part d plan—the coverage gap. Once you and your plan have spent $4,430 in total drug costs, you are officially in the coverage gap and medication costs increase. The donut hole is the coverage gap in medicare prescription drug plans.