Data on the report is based on a survey of 2,837 patients who checked into a hospital or. There’s more room to negotiate medical bill payments, unlike some other debts.

Many medical providers offer a wide range of payment plans for people with different needs.

Medical bills payment plan. It’s usually easier than negotiating a settlement since the provider will eventually get their full balance. This may occur when a provider bills for a procedure that is not included in a patient’s insurance coverage. Did you know that a high percentage of medical bills contain some kind of error?

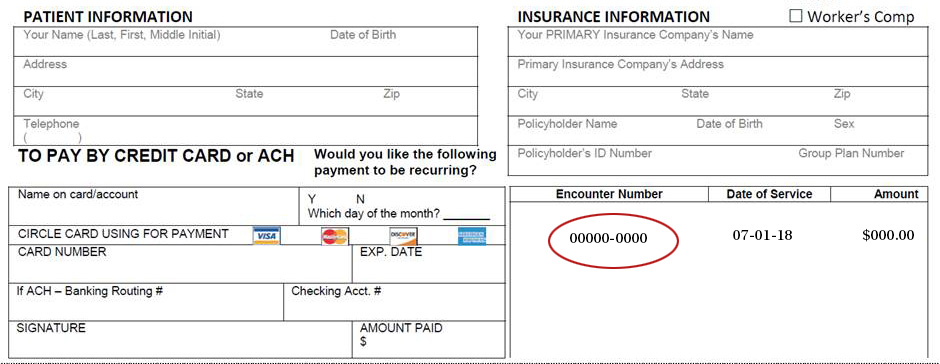

Patient payment plan i, _____, the patient, (account # _____) understand that i am agreeing to the following payment plan between myself and family health care center. Display cost of treatment, estimated insurance coverage, payment arrangements, and more with this simple healthcare payment agreement template. After you receive your care, you’ll receive a bill from.

Among the findings of “ the changing landscape of healthcare payment plans ” study, released last month, through the joint efforts of pymnts and flywire: If you’ve fallen into medical debt and need medical debt relief, consider the following organizations that help pay medical bills. Check all medical bills for.

To manage overwhelming medical bills, 65% of consumers surveyed said they want to discuss payment plan options with their doctors, though only 45% had ever done so. The document may be used for a wide range of services from a standard doctor’s. But there is no law for a minimum monthly payment on medical bills.

How to pay off medical debt. Payment plans and your medical bills. (that’s not exactly a comforting thought, is it?)

While you are waiting for your insurance company to pay a medical bill or if you are disputing the bill. These plans split your total bill into equal monthly payments over a set period, making your payments more manageable. Confirm the amount that you actually owe.

A denied claim is one that the payer refuses to process payment for the medical services rendered. Medical payments also come with low or no interest, which is definitely not true of most other debts. Find out who is the bill collector in charge for that provider.

Review your bill with your doctor’s office, especially if you have questions or concerns about a particular aspect of your bill. A payment plan for medical bills involves the following steps: If you’re proactive and request this early on, the terms are usually favorable.

If you plan to ask your hospital for help reducing your medical bill, consider taking the following steps: Almost every hospital will work with an honest consumer. In this short guide, we’ll discuss how to pay medical bills with a plan of attack for reducing and paying off medical debt.

Medical bills are always accurate; Experts advise to pay the mortgage and credit card bills first, but do not ignore the medical bills. If a payment plan is possible, consider it.

This patient payment agreement template is preformatted for any healthcare professional. You need to contact yours and explain your situation so that you can figure out the best solution that will work for both of you. The struggle to pay medical bills is.

Medical bills can often have errors, so carefully check your bill first before asking for any kind of reduction. Check your hospital bill for errors. However, if you�re having a hard time even with a payment plan, hospitals have an.

Bills you don�t have to pay during the coronavirus pandemic. Medical debt is a growing problem in the united states. Otherwise, you’ll end up having to do the process over again.

Confirm the amount and check with your insurer. Organize the overdue bills into manila or digital folders and put the name of provider who charged you on the manila or digital file. Many medical providers offer a wide range of payment plans for people with different needs.

Healthcare providers won’t pay your medical bills for you, but they do have the power to reduce or completely drop them. Data on the report is based on a survey of 2,837 patients who checked into a hospital or. Consider a payment plan, a medical credit card or hiring a medical bill advocate.

Many people have heard an old wives’ tale that you can just pay $5 per month, $10 per month, or any other minimum monthly payment on your medical bills and as long as you are paying something, the hospital must leave you alone. A federal reserve board found in 2020 about 40% of americans would have difficulty paying a $400 medical bill. Many insurance plans don’t cover all your medical expenses.

One of the most common ways to negotiate an exorbitant medical bill is to ask for a payment plan. A medical payment plan agreement is a written agreement for any patient who has received health care services and agrees to pay their balance due over a period of time. There’s more room to negotiate medical bill payments, unlike some other debts.

Set up a healthcare payment agreement with a patient with this useful accessible patient payment agreement template. As with anything that really matters, there are a few things you can do to streamline the process. What to ask before setting up a payment plan one option that may help you manage big medical bills is working with your provider to set up a payment plan that allows you to spread the cost of care over a longer period of time.

Treat medical bills like any other debt: You have a few options when it comes to how to pay off your medical bills. Organizations that help pay medical bills.

Personalized payment plans are the primary way hospitals and other health care providers assist patients with medical bills. If they approve a special payment plan, you’ll be able to. A simple conversation can end up saving you hundreds of dollars.

You don’t have to worry about medical debt if you have insurance. As long as you pay something, and set up a payment plan you can get by making smaller payments for a while. For a medical billing advocate, expect to pay an hourly rate or sacrifice a percentage of savings.

Healthcare providers such as your hospital. Some doctors, hospitals, and healthcare providers give their patients the option of a medical bill payment plan. You don’t owe right away;

I further understand that i must sign this agreement for it to be valid. The use of these plans has increased significantly in some organizations and is present in 1 in 5 outstanding patient accounts, according to experian health. There is no federal law that prevents a medical provider from turning a medical bill to collections when you are making payments on it.

“you may be able to work out a payment plan directly with your medical provider, possibly even with low or no interest. Before beginning on a payment plan, make sure you’ve reduced your medical bill to the lowest possible cost you can. Millions of americans struggle with high medical bills.